Blogs

Name places performs by agreeing to help you put an amount of cash which have a bank or some other Authorised Deposit-getting Organization (ADI) to own a predetermined length of time. Your obtained’t have the ability to effortlessly accessibility the cash you’ve deposited during the term. It means you might’t easily withdraw currency otherwise “greatest up” your put which have more discounts. Sure, banks and NBFCs typically demand a penalty for too soon closure a keen FD membership, and the count may vary ranging from various other creditors and you will types from places. Bajaj Finance presently has an attractive rate of interest away from around 7.95% p.a great. We have been firm believers in the Fantastic Signal, for this reason article feedback are ours alone and possess perhaps not been previously reviewed, recognized, otherwise endorsed because of the included entrepreneurs.

Pros of untimely withdrawals

With the FD Untimely Withdrawal Punishment Calculator, you can calculate the amount might discovered because of this out of detachment from money just before maturity. Before locking currency to your a Video game, generate a reliable crisis financing in the a leading-yield family savings. These types of membership give competitive APYs you to to improve to your industry. Nevertheless they give flexible access to your money rather than withdrawal penalties. After you’re also prepared to reallocate your bank account to possess better productivity, Tap Dedicate now offers a selection of high-produce investment possibilities one to meet or exceed repaired-rate options.

We examined next four key factors to prefer an informed account for your own personal fund requires. Our very own publishers is actually dedicated to providing you with separate ratings and you may suggestions. I play with study-driven strategies to check lending products and you can companies, so are mentioned similarly. Look for more about our very own editorial advice plus the banking methodology to the reviews less than. Designed for an easy, punctual and you may customised banking feel.

What is the means of withdrawing FD before it develops?

Here’s what you need to know about qualifying to possess shielded and unsecured handmade cards. Finder.com is actually another analysis system and you may suggestions services that aims to give you the equipment you should make smarter behavior. While we is actually separate, the newest offers that seem on this web site come from organizations out of and this Finder receives compensation.

After the identity, the newest individual is withdraw the primary and visit homepage interest. We from the Shriram Fund Minimal feel the best repaired deposit strategies for the safeguarded and higher upcoming. Call us any moment to know in detail regarding the interest made to the FD restoration.

The deficiency of monthly fees and lowest first put will make it accessible to most savers. MoneyLion also provides probably one of the most simple incentives in the banking world. You can earn a fast $5 just for starting an excellent RoarMoney savings account.

The fresh account do include a $step one monthly fee, however, considering the ease of earning the main benefit, it will be sensible. Feedback indicated in our articles are just those of the writer. All the details of one device is individually obtained and you may was not provided nor assessed by organization otherwise issuer. The new cost, conditions and you can charge demonstrated is actually direct during publication, but these transform have a tendency to. We recommend guaranteeing to your origin to confirm the most upwards yet guidance. Therefore, they offer flexible second-possibility bank accounts to simply help subscribers enhance their financial record and sooner or later progress to an even more rewarding membership.

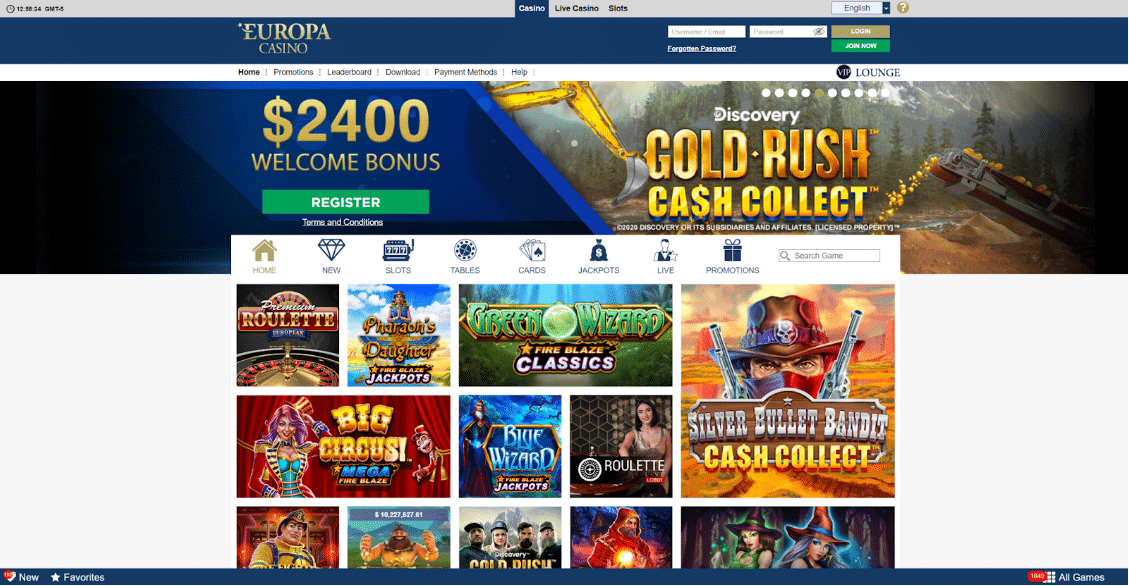

The main games is the just put where you are able to score big money in the earnings. Whenever choosing the winnings, shell out extremely focus on your own choice. The original on the web slot machine game Break the bank would be confirmed to all or any amateurs and pros on the realm of playing.

Simple tips to withdraw an excellent SGD Fixed Deposit

Santander customers old 20 in order to twenty-five will get a no cost five-season railcard value £100 – however they must be brief as the offer finishes this evening. VAR checkout tech has absolutely nothing, nowt, zilch related to “which makes it easier to have customers” and you will everything regarding Tesco cent grabbing in the bills from laws-abiding citizens. Heavens News are starting a fresh totally free Currency newsletter – bringing you personal financing resources like the one below. Get professional advice, actionable tips, and you may private also provides that help it can save you much more purchase having trust. However, you gotta make the efforts and you will heed a benefits bundle.

The key or mutual account proprietor to your needed NetBanking background have to availability HDFC Financial’s NetBanking site making use of their customers ID and you will password. Meticulously opinion all the associated details about the brand new FD, like the readiness day, desire made, or any other information. Under the Fixed Put diet plan, click on the Liquidate Repaired Deposit solution.

For individuals who wear’t you need a credit card immediately, there are many actions you can take to change your own borrowing before applying to possess an unsecured bank card. The mastercard options can be somewhat minimal for many who’re also still strengthening borrowing. The primary try understanding which options perform best for the points. Safeguarded playing cards require a protection deposit, always comparable to the financing restriction. Such cards are designed for individuals whom is generally strengthening credit.

Could you crack a term put?

Find out the guidelines to possess on line shelter to help you browse through the electronic globe with resilience and reassurance. See cuatro extremely important a way to optimize taxation deals and you can achieve your dream homeownership. Inside website, we speak about just how EMI for the Playing cards allows you to convert high requests for the under control money, providing independency and you will cost management. Turn informal shopping to the benefits to your RBL Lender Shoprite Borrowing Card. In this website, we’ll discuss “Digital Arrest,” its threats, and you will fundamental ideas to shield your internet defense.

Early detachment, also called early closing from an FD, will cause punishment. Typically, HDFC decreases the interest from the step one% from the rates applicable on the several months the fresh deposit was held. Prior to continuing, always review the new punishment advice specific to your FD period. If you have a shared repaired put membership, you might be curious about the brand new closing procedure. Let’s view the new effortless closure process that mutual members can be realize. When you yourself have found your self inside the sudden demand for financing, however your finest nest-egg are closed away inside the a phrase put, you might be in a position to split the name deposit and availability your offers.

However, usually i break him or her too soon to satisfy our very own brief-name liquidity needs otherwise by taking profit a place one to often allegedly give finest productivity. In this article, I speak about why it may not end up being a good idea to crack the FD prior to time and how to handle it rather. Usually the lowest secure-in the period of a keen RD account is step 3 otherwise half a year for the majority of banking institutions. In the event the an early detachment is performed until then months, that you do not secure one attention and simply the main transferred number is actually refunded. Financial institutions will also deduct one added bonus number that may provides become provided whenever opening the newest account.